Effective financial planning can lead to financial savings, and likewise, adept tax planning empowers us to invest wisely, thereby conserving funds for judicious budgeting.

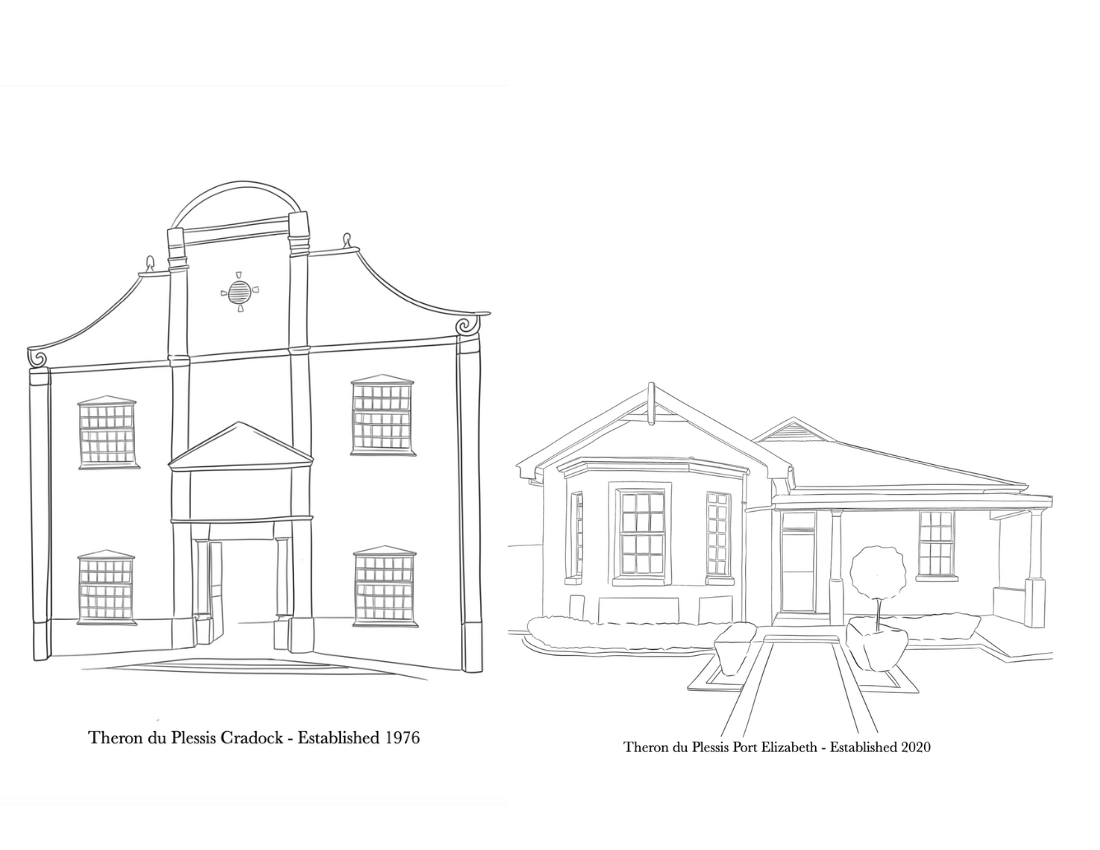

TDP – 50 Years Old / 50 Years Young

At TDP Accountants and Auditors (formerly known as Theron Du Plessis), we are looking forward to celebrating our 50th year in business, a testament to our reputation as a trusted and experienced company.

TAX AND DISABILITY – ARE YOU CLAIMING YOUR FULL TAX RELIEF?

A living trust can be very useful in estate planning if set up correctly and for the appropriate purposes, but before determining whether a trust is suitable for your purposes, it is important to weigh up the advantages and disadvantages of doing so.

UNDERSTANDING FRAUD IN YOUR BUSINESS AND HOW TO PREVENT IT

If you are looking for expert guidance and support with your SARS submissions we are here to help.

B-BBEE AND YOUR BUSINESS: WHAT YOU NEED TO KNOW

If you are looking for expert guidance and support with your SARS submissions we are here to help.

SARS SUBMISSIONS DEADLINE FOR THE END OF MAY 2023

If you are looking for expert guidance and support with your SARS submissions we are here to help.

SOUTH AFRICA’S NEW ROOFTOP SOLAR TAX BREAK – HOW DOES IT WORK FOR INDIVIDUAL TAX PAYERS?

Finance Minister Enoch Godongwana stated during his budget speech that South Africans will be eligible for tax rebates of up to R15,000 for solar panels beginning on March 1 2023. How does the tax break work for individual tax payers: South Africa’s new rooftop solar tax break has led many people to believe that solar energy sources are their best bet for securing a reliable power supply. But, although solar energy offers homeowners a single, cost-effective alternative, “cost-effective” does not always equate to being easily affordable. Some of the things to consider: